My memories of bonfire night as a child are of being bundled up in a hat, scarf and gloves. I … More

Author: Rachel

Thoughts on 2025

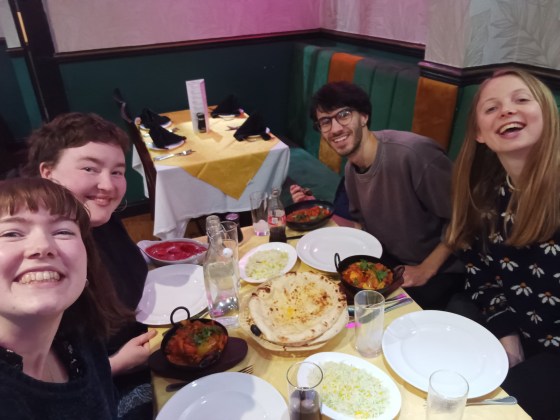

The best part of this year has been Anna and Joe arriving to the house. There’s a list of Anna-isms … More

Bus Stop Nativity

Where should we go looking for God? Advent means the “coming” or arrival of God. It’s a season of fasting … More

Growing up

I was hanging out with a three year-old last week. He came into the kitchen to make an announcement. In … More

Amsterdam to London with Bart

Amsterdam to London with BartBart is 98. His cells are leaving “in droves,”but he’s still signing card numbers to a … More

The Art of Crying

I borrowed a short zine book from Kristin to read on the train the other week. Called “The Art of … More

10 things I hate about cars

I still associate long car journeys with the excitement of going on holiday as a kid. I remember the fun … More

Year 3 – cherry tree house

Earlier this year, Lucy sent me ‘Metaphysical Animals’ in the post. It profiles the philosophers Iris Murdoch, Philippa Foot, Elizabeth … More

Living in a world of systems

I’ve just finished reading Donella Meadow’s seminal work ‘Thinking in Systems’. It’s excellent. The book goes through systems principles in … More

What holds the swifts

The type of bright sunshine which gives grass an extra sort of lurid dimensionality is the same sort of sunshine … More

The financial system

“Money is the oxygen on which the fire of global warming burns” Bill McKibben (Consider reading The Economy before you … More

The Economy

“The sign of a healthy economy should be a drinkable river.” Li An Phoa We talk about “the economy” as … More